Tax season brings a unique kind of chaos to accounting professionals. The endless stream of client documents, constantly changing tax codes, and looming deadlines can make even the most seasoned tax preparer feel overwhelmed. But what if this tax season could be different? What if you could maintain laser-like focus and actually leave the office before midnight?

Why Focus Matters More Than Ever for Tax Professionals

In today’s hyperconnected world, tax preparers face more distractions than ever. Between client emails, text messages, software updates, and the occasional social media notification sneaking through, maintaining concentration has become increasingly difficult. Yet, during tax season, your ability to focus directly impacts your accuracy, efficiency, and ultimately, your sanity.

Research shows that after an interruption, it takes an average of 23 minutes to fully return to the task at hand. For tax preparers working on complex returns, these interruptions can be particularly costly, leading to errors that might trigger audits or unhappy clients.

The Real Cost of Distraction During Tax Season

Beyond the obvious time waste, constant task-switching creates mental fatigue. When you’re jumping between client files, tax software, email, and phone calls, your brain is forced to continually reorient itself. This cognitive load doesn’t just slow you down—it dramatically increases the likelihood of mistakes on tax returns and depletes your mental energy faster.

Many tax professionals report that their most productive work happens either very early in the morning or after normal business hours when interruptions are minimal. This pattern reveals an uncomfortable truth: our standard workday environment may be fundamentally incompatible with the deep focus tax preparation requires.

Time-Blocking Techniques That Actually Work for Tax Preparers

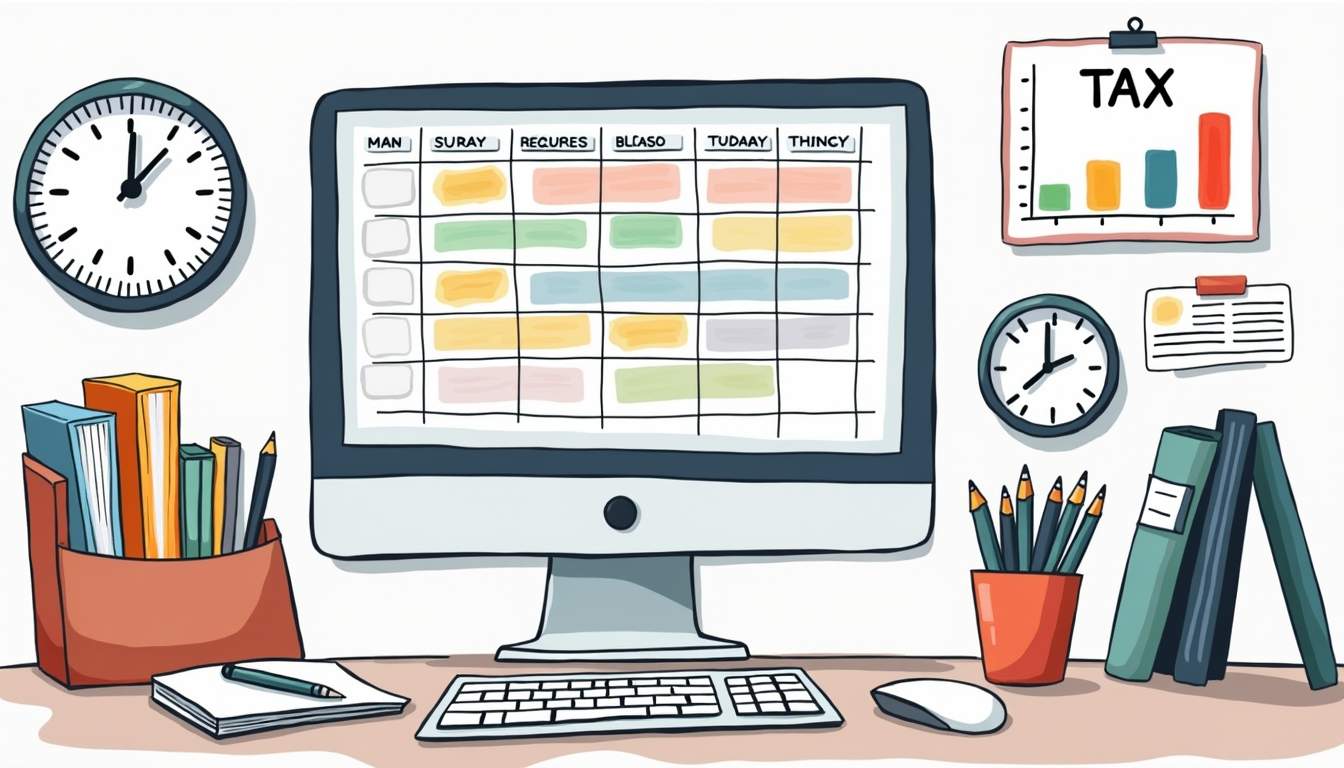

Time-blocking isn’t just another productivity buzzword—it’s a lifeline during tax season. The concept is simple: instead of reacting to whatever demands your attention next, you proactively schedule specific blocks of time for different types of work. For tax preparers, this approach can transform your workday.

The Tax Preparer’s Ideal Daily Schedule

Consider structuring your day with these dedicated time blocks:

- 7:00-9:00 AM: Deep focus work on complex returns before interruptions begin

- 9:00-10:00 AM: Email and communication response time

- 10:00-12:00 PM: Client meetings and calls (batched together)

- 12:00-1:00 PM: Lunch break (yes, actually take one!)

- 1:00-3:30 PM: Return preparation and review

- 3:30-4:00 PM: Email check and urgent responses only

- 4:00-6:00 PM: Finish complex work or administrative tasks

The key is setting boundaries around these time blocks. Let clients know your communication schedule, set your email to offline mode during deep work periods, and consider using a physical “do not disturb” sign when you need uninterrupted focus time.

Using the Pomodoro Technique with Focus Keeper

The Pomodoro Technique—working in focused 25-minute intervals followed by 5-minute breaks—is particularly effective for tax professionals. The Focus Keeper app has become a favorite tool among accountants for implementing this method during tax season. It offers a simple, customizable timer that helps maintain concentration during complex calculations and form completions.

What makes Focus Keeper especially useful is its ability to track your focus sessions over time, giving you insights into your productivity patterns. Many tax preparers find they can complete an entire simple return within just 1-2 Pomodoro sessions when fully focused, compared to the scattered approach that might take twice as long.

Digital Organization Systems That Prevent Mental Overload

The days of physical file cabinets may be fading, but the need for meticulous organization has only increased. Digital clutter can be just as distracting as physical mess—perhaps even more so because it’s less visible but constantly accessible.

Client Document Management That Reduces Cognitive Load

Create a standardized digital filing system for each client that follows the same pattern. For example:

- Client name – Tax Year – Source Documents

- Client name – Tax Year – Working Papers

- Client name – Tax Year – Final Returns

- Client name – Tax Year – Correspondence

This consistent structure means you never waste mental energy wondering where something might be filed. Some tax preparers take this a step further by color-coding client folders based on complexity or status (awaiting documents, in progress, ready for review, etc.).

Task Management Systems That Keep You On Track

Rather than keeping mental track of dozens of returns in various stages of completion, implement a visual task management system. Tools like Trello or Asana allow you to create boards with columns representing different stages of your tax preparation workflow. Each client becomes a card that moves through these stages, giving you an instant visual overview of your workload.

For example, your columns might include: Awaiting Documents, Documents Received, In Preparation, Ready for Review, Reviewed, Filed, and Delivered to Client. This approach not only keeps you organized but also provides a satisfying visual representation of your progress throughout tax season.

Physical Environment Tweaks for Maximum Focus

Your physical workspace significantly impacts your ability to concentrate. During tax season, optimizing this environment becomes even more crucial as you spend extended hours at your desk.

The Ideal Tax Preparer’s Desk Setup

Consider these practical adjustments to your workspace:

- Dual monitors: Research shows tax preparers with dual monitors complete returns 44% faster than those using single screens

- Noise-canceling headphones: Essential for open office environments or home offices with family distractions

- Ergonomic chair and desk: Prevents physical discomfort from becoming yet another distraction

- Dedicated phone-free zone: Keep your smartphone in a drawer or another room during deep focus blocks

Many tax professionals also find that having a secondary workspace for client meetings helps maintain their primary desk as a focused work environment without the clutter of client documents and materials.

Sustainable Focus Habits Beyond Tax Season

While these strategies are particularly valuable during the intensity of tax season, they’re worth maintaining year-round. Building consistent focus habits during less demanding periods makes the transition to tax season intensity much smoother.

Weekly Focus Reviews and Adjustments

Take 15 minutes each Friday to review what worked and what didn’t for your focus that week. Did certain times of day yield better concentration? Did specific types of returns require different focus strategies? Use the Focus Keeper app’s statistics to identify patterns in your productivity and make adjustments accordingly.

Remember that focus is a skill that improves with practice. Each tax season presents an opportunity to refine your approach, building habits that will serve you throughout your career. By implementing these strategies consistently, you’ll not only survive tax season—you might actually thrive during it.